How To Calculate Your Wedding Budget

“...with the average wedding cost totaling $30,000+ nationwide, the Big Day often accounts for the 3rd largest spending decision an American family will ever make... right after buying a home and sending your kid to college.”

Most women don't start the wedding planning process by creating a budget.

Let's just be honest! You probably hopped on Pinterest, creating boards of your favorite gowns, venues, and flower arrangements, or by picking up a magazine at the grocery store to get some ideas of your style and taste.

But with the average wedding cost totaling $30,000+ nationwide, the Big Day often accounts for the 3rd largest spending decision an American family will ever make... right after buying a home and sending your kid to college.

So as a money coach and financial advisor who just so happens to have built a successful business in the wedding industry (and now proud owner of an event/wedding venue in Kansas City) I figured it's about time I tackle this topic!

So this week on Fierce Feminine Finance, let me share with you wisdom I've gained while helping over 300 couples plan their wedding, and helping hundreds more to create a solid budget and roadmap to financial freedom. Here's how to calculate your wedding budget so you can have the Big Day you're dreaming of... without filing for bankruptcy afterward, or crippling your ability to buy a home and start a family.

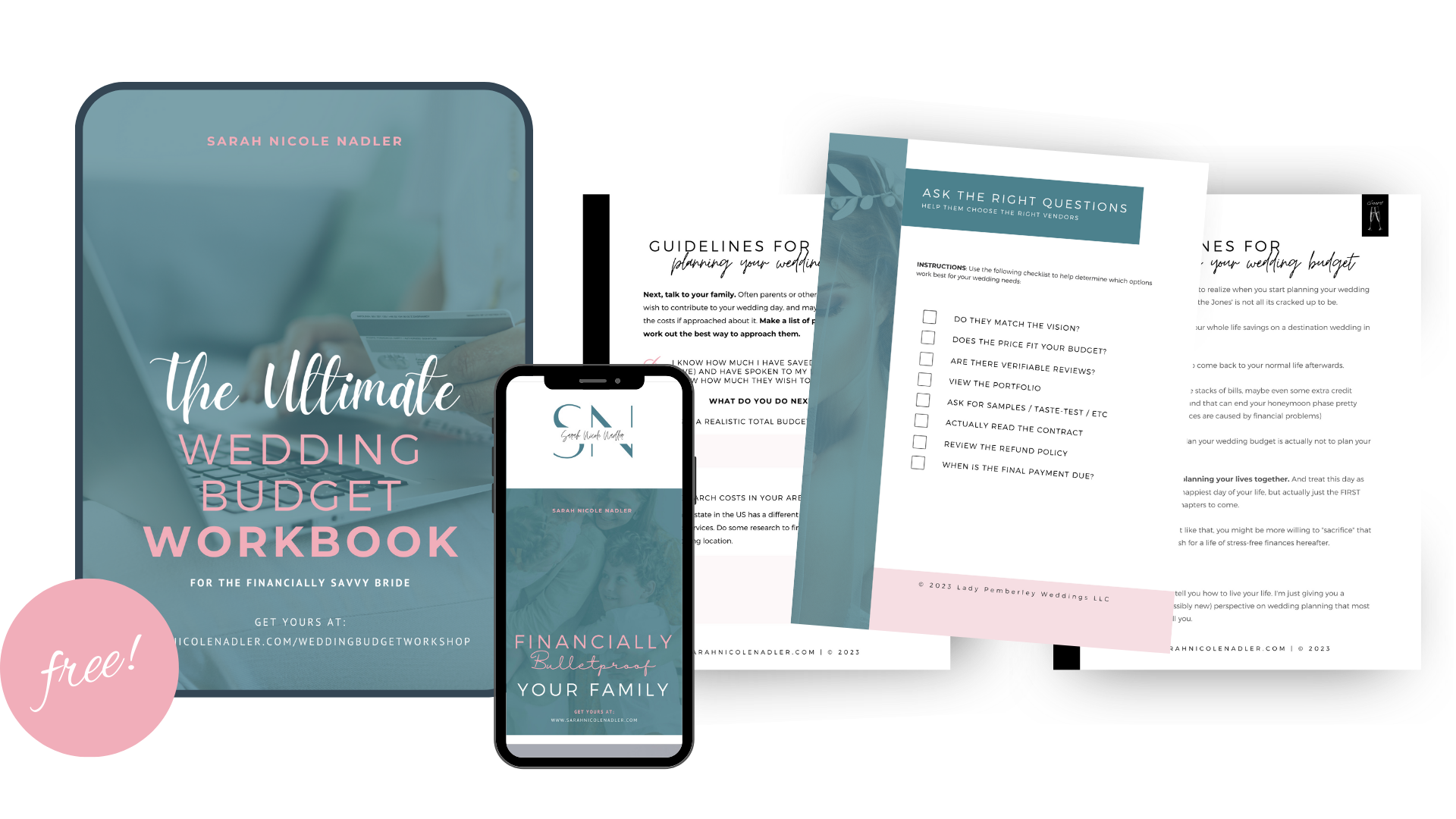

With every episode of Fierce Feminine Finance, I like to empower you with a POWERFUL free resource that goes with the episode which you can implement right away to create some of the same results, if not better, in your financial strategy.

This week, since we are talking about how to avoid the most common wedding budget mistakes I see high-earning women make, I put together an Ultimate Wedding Budget Workbook to help you implement the strategies I talk about here...and a few extra I didn't mention!

After going through this freebie you will be able to identify exactly how to plan your wedding without going over budget. So you can still afford to start a family, buy a home... or even start investing!

You can download it right away by clicking here or on the photo above 👆

With that said, here are 5 things to consider and mistakes to avoid when planning your wedding budget calculation! 👊

1. Start With A Realistic Assessment of Available Funds

While it can be tempting to put wedding expenses on a credit card or borrow the money, it's important to remember that arguments over money are the #2 reason for divorce in the United States!

So creating that kind of high-pressure situation for yourselves at the beginning of your marriage is not a great idea.

Instead, get creative with sourcing funds for your wedding!

While it is traditional for the parents of the bride to pay for the wedding, that custom has faded over time, and it is becoming increasingly common for couples to handle at least half of the wedding expenses on their own.

Here are some ways to find the funding:

Ask family/close friends if they want to help. You would be surprised how many people are offended that their children/friends/favorite niece failed to ask them if they wanted to contribute! People who love you will appreciate a polite approach that invites them to support your Big Day without pressure to do so.

Open a savings account or cash envelope. You can't go wrong by setting aside a little out of your own discretionary income toward your dream day... if such extra cash exists.

Ask for opportunities to earn. If you're a female entrepreneur or side hustler, let your audience know you're planning a wedding and ask for referrals! Consider running a flash sale or special offer to bring in a cash injection to your business.

For more established business owners, consider informing your team of your engagement and asking their support to make it happen. I've had success with client when we offered a profit share or bonus system if they helped the owner hit a quota to make their dream wedding possible. Note: if you have disgruntled employees or aren't taking care to provide a living wage and appropriate benefits to your team, broaching this topic can trigger a negative response! Just one more example of why taking good care of your employees can pay dividends when it's your turn ;-)

Do you need help hiring, training or troubleshooting behavior within your team so you can take time away for your wedding and honeymoon? Click here!

2. Sit Down As A Couple And Make A List of Financial Goals for The Next Ten Years

This is advice you won't find on WeddingWire, The Knot...or from your local wedding vendor!

But here's the hard truth you probably don't want to hear:

Despite what wedding vendors will tell you...your wedding day is NOT really the happiest day of your life.

It's actually just the FIRST day in what will (hopefully) be the happiest chapter.

But... for your relationship to have the best possible chance at success and happiness, a good rule of thumb when planning your wedding is to begin as you plan to go on.

In other words, if you fight a lot over the wedding plans, you'll likely find that fighting is a habit you fall back on in other high-stress situations down the road when you have differing opinions.

If you overspend while planning your wedding, you are probably going to find that overspending and making emotional purchases you later regret is a habit, too... and that will make it hard to stick to a budget later on.

So in order to set yourselves up for the healthiest, happiest relationship you could possibly have...

A good rule of thumb for your wedding budget is to base it on how high priority this ONE day truly is in your overall financial plan.

Ick... that's tough to swallow, isn't it?

But just think: how happy will you REALLY be to receive the bills after your wedding day is over?

And how much happier might it make you if you spent MORE money on starting a family, investing and building wealth... than you do on a SINGLE day in a white gown?

Food for thought.

3. Decide On A Wedding Style, Size & Location

The total cost of your wedding will be influenced by factors like location, distance to travel, time of year, number of guests and wedding style (formal, informal, etc).

Therefore it's a good idea to start costing out your ideas before you settle on a final budget.

This is a place where BIG savings can happen without sacrificing your desired theme or looking cheap, so it's important to get this right!

For example, choosing an open-air venue like a park, farm, or large backyard could save you thousands (or even tens of thousands!) in venue fees... but it does tend to limit the season in which your wedding can be held.

Similarly, a destination wedding tends to cost more than a local one. And an elopement (<10 guests) or micro wedding (<50 guests) will usually be less than a wedding with 300 guests.

Another way to save on costs without sacrificing your dream wedding is to consider unique and creative catering styles. A picnic wedding from Costco is going to cost pennies on the dollar to what a catering company would charge for a full service 5-course meal (and with the right day-of coordinator could still look great on Instagram).

4. Make A List of Your Major Wedding Expenses

A good way to do this is to start with a comprehensive list of potential expenses and narrow it down based on affordability:

Venue

Rental fees for tables and chairs

Officiant’s fees

Marriage license

Catering

Alcohol

Wedding cake

Favors for guests

Bridal party/groomsman gifts

Bachelor/bachelorette party

Flowers and decor

Photographer/videographer

Music and entertainment

Wedding invitations/stationery

Bride and groom attire

Hairstyling/Makeup

Wedding bands

Transportation

Rehearsal dinner

Remember to prioritize these expenses based on your values. What is most important to you? Traditions and societal pressure will always be there... in this as well as every other money decision you ever make.

Choose based on what YOU care about, and make sure you are looking ahead and how this choice will impact your finances ten years from now... not just today.

5. Avoid These Common "Cost Cutting" Mistakes

Okay, we've talked about ways to be a budget-savvy bride...

But what about when you DO have extra cash and want to splurge a little to make your Big Day extra special?

Here are a few cost-cutting mistakes I see brides make, and where I would throw a little extra money to make everything truly magical:

Choosing a “cheaper” venue, but not taking into account if they are all-inclusive or supply rentals is a mistake. Why? Some all-inclusive venues have high catering minimums you have to meet that can put you over budget if you don’t allocate accordingly. Other venues might be less expensive, but all you get is the venue, so you need to take into account paying for tables, chairs, linens, dinnerware, glassware, etc.

Many couples think having a wedding at home in the backyard is cheaper, when it can be much more expensive! Tents, power, bathrooms, parking attendants, and permits from the town can quickly add up! Also, renting everything and removing trash/recyclables can really put you over budget.

Forgetting to factor in service charges and taxes can be a big mistake. Make sure you’ve read your vendor contracts carefully and factored in service charges and taxes. Service charges can run from 22-30% and can come from your venue, caterer, beverage service, and a variety of your other vendors. Taxes vary from state to state, but can heavily affect your budget’s bottom line.

Have a little extra cash in your wedding budget? The BEST place to spend it is on a day-of coordinator. These wedding-savvy experts are like having a personal assistant and wedding planner all rolled into one. There is nothing better than relaxing and enjoying your Big Day because you've got a Girl Friday going OCD about the details...so you don't have to.

A Beginner-Friendly Class On Investing & Building Passive Income for Business Women and Entrepreneurs

Get my exclusive strategy for turning your intellectual property into passive income and growing it to 5-figures per month and beyond! FREE

© Copyright 2024 Sarah Nicole Nadler LLC. All rights reserved.

2022 All Rights Reserved.