How To Ethically Use Other People's Money To Grow Your Business

The other day, a client of mine reached out to ask whether I thought it was a good idea for her to go into debt to purchase a state-of-the-art machine for her healthcare practice.

She had the opportunity to take out a loan at 0% interest for a year, followed by 6% after the introductory rate expired.

This machine would allow her to offer a new service to her existing clients at a higher rate than any services she currently offers.

She had already surveyed her existing clients (so proud of her!) and found that several were interested in the service now, and many more said perhaps in the future.

But she was hesitant to pull the trigger.

She had always been taught that debt is “bad” and wanted to be smart about the way she grows her business.

So even when I showed her that the machine would easily pay for itself in less than a year…she hesitated.

Moments like this, I really hate Dave Ramsey. *sigh*

The idea that debt is bad is such a false idea that I can only shake my head when someone tells me this!

Sometimes you have to shed limiting beliefs before you can grow your business.

A typical person when she wants to buy something - her first thought is to pay for herself.

As a business owner, she wants to expand her business by buying a new building, with buying new equipment like laptops... her first thought is how to dip into her own pockets.

And this is a LIMITING BELIEF that holds so many business owners back.

If you are a business owner and want to grow your business, then you have to get rid of the false idea that debt is always bad.

So in this episode, I want to share with you my top tips for how to use other people's money to grow your business so that you can enjoy being a business OWNer and spend time doing more interesting things... not stay a hustler all your life.

How To Use Other People's Money To Grow Your Business - Episode 82

With every episode of Fierce Feminine Finance, I like to empower you with a POWERFUL free resource that goes with the episode which you can implement right away to create some of the same results, if not better, in your business.

This week, since we are talking about strategies to avoid risking your own personal credit or savings while growing your business, I put together a Business Credit Checklist so you know step-by-step how to implement this strategy.

After going through this freebie you will be able to build up your business credit and use other people's money to grow your business.

You can download it right away by clicking on the button above 👆

What is the OPM Technique And How Can You Benefit From It?

Now don’t get me wrong…

You COULD go into high-interest (ie - credit card) debt buying things that won’t cash flow for you and quickly find yourself trapped.

BUT…

That’s not what I’m talking about.

I’m talking about a strategy that the top 1% of wealthy Americans use EVERY. DAY. to ethically use other people’s money to grow your own wealth.

A lot of business owners risk their own personal savings when starting a business.

(Don’t get me wrong…I’ve made this mistake too!)

Worse, when they start researching the OPM (Other People’s Money) Strategy, many business owners risk their own personal credit, too.

This puts your family at risk by risking your home and other personal assets!

Instead, we want to build up business credit so you can borrow money like my client did…at low interest, and only spend it on investments that have the potential to cash flow at a rate higher than the debt.

If you can borrow money at a lower interest rate and use it to invest in an asset that makes you money at a higher rate of return...this is leveraging Other People’s Money (OPM).

Let's explore some of the ways to grow your business by using other people’s money:

1. Take A Loan From A Bank

You can take a loan from the bank to grow your existing business. You have to give them assurance that by investing this money, you are able to make more money so you can return that loan at a specific interest rate.

Let's take an example.

If you borrow $20k at 0% APR to buy a machine that will bring more money into your business, the first thing we have to ask ourselves is…how much do I need to make in the first year to pay this off?

The wrong answer is $20,000.

Why? Because you haven’t factored in how much it will cost you to deliver the service.

If this machine will allow you to offer an additional service that requires no marketing, or added manpower and materials then perhaps you could do this. But that is very unlikely!

So the next question we have to ask is what percentage of the sale of this service will be profit?

Let’s say that the $20k machine will allow you to offer a $500 service.

Each sale requires an extra hour of your time, plus $30 of supplies.

If you’re paying yourself $100/hour, that means $130 of your $500 is the cost of delivery.

If we also include 10% for marketing costs, that means you have $320 in profit for each sale.

Depending on your tax rate, you likely can spend about $200 of that on paying the debt back.

So it will only take you 100 sales to pay off the $20k debt.

In the case of my client, she could easily do that in a few months! Which means she will have made a profit on the machine that she bought without risking her own credit or money…and after a few months will have an additional high-profit income stream for her business.

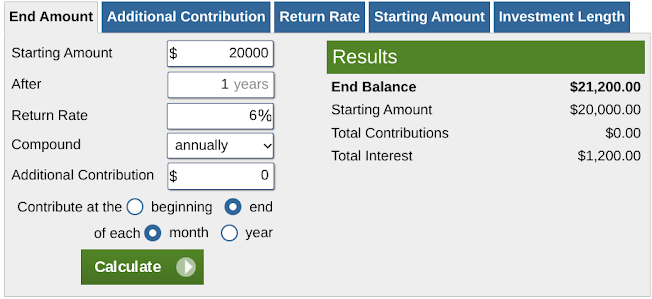

Now let’s say she wasn’t getting it at 0% for a year. Let’s pretend, for a moment, that she was going to owe 6% on the machine from day one.

That would have looked like this:

After a year, she would have owed $21,200 instead of $20k. (That’s if she never made any payments)

In her case, that’s STILL irrelevant because she only needs to sell the service 106 times to pay that off! Since she sees 50-60 clients per week already, that’s easy peasy lemon squeezy.

So why do we fear debt?

Because some old rich white guy told you it's bad?

Consumer debt is bad! Spending money on things that have no return…risking your personal credit on vacations, cars, and other things that depreciate over time is not smart.

But OPM? Using the bank’s money (or an investor’s money) to grow more money? That’s about as smart as it gets.

2. Private Loans

Another way to use OPM is a private loan. You can ask for a loan from a friend or a family member, with a written contract stating how the loan will be paid back. It acts as a mutual benefit because you get the money you need to build your business, and they get the interest on that loan.

So long as you can spend that money in a way that will make you MORE money than the amount you're having to spend on interest - borrowing money is a very good idea!

It's the difference between "bad" debt and good debt - good debt is making you more money than it is "wasting" in interest.

Bad debt isn't making you anything.

3. Angel Investors

An angel investor is an individual who provides capital for a business startup, usually in exchange for interest on the debt or ownership equity.

Angel investors are great because normally at the beginning it can be difficult to secure traditional lending. Once your business grows, there are more likely chances that many people will want to invest in your company.

4. Rental Real Estate

Borrowing money to invest in rental real estate, which is another wealth-building technique, allows you to leverage other people's money by making more in the rental fees than the mortgage is costing you.

You can pay off the rest of the loan with money from tenants who rent your properties. You get to retain the profits as well.

Furthermore, any interest paid on the rental property loan, as well as other costs such as depreciation, maintenance, and advertising your rental, are all tax-deductible. Your rental property can provide you with many income sources without a large time investment.

In Summary

Alright! Hope you will find this episode helpful.

In other words, no matter what method you use to grow your business, whether it's through a bank loan, a loan from a close friend or a relative, or an investor putting their money into your business, these methods will allow you to spend someone ELSE's money!

It's true that it all comes down to the mindset.

When you find an opportunity either you dip into your own pockets first or you look for an opportunity to exchange and trade the value for money that belongs to others.

And it is a wonderful way to grow your business.

So, take a look at your business and investments you wish you could make, and ask yourself, "Am I being held back by an employee mindset? Or am I ready to start investing with other people's money?"

A Beginner-Friendly Class On Investing & Building Passive Income for Business Women and Entrepreneurs

Get my exclusive strategy for turning your intellectual property into passive income and growing it to 5-figures per month and beyond! FREE

© Copyright 2024 Sarah Nicole Nadler LLC. All rights reserved.

2022 All Rights Reserved.