Why Big Finance Wants Your Money In A 401(k)… And What To Do Instead

“You cannot escape the responsibility of tomorrow by evading it today.”

Do you ever wonder what the BEST retirement strategy is for women in business?

If you asked a banker, traditional financial advisor, or other member of "Big Finance" they would probably tell you to open a Solo 401(k) as all or part of your retirement plan.

But with 78% of Americans behind on retirement... you have to wonder: IS this financial advice based on an honest assessment of YOUR financial goals, or simply a suggestion meant to cushion their own bottom line?

Let's explore.

This week on Fierce Feminine Finance, gain a deeper understanding of why the Solo 401(k) approach might not be your best bet for retirement as a business woman, and more importantly, you’ll discover actionable strategies to pave your way towards financial freedom through passive income generation. Get ready to take control of your financial destiny and retire on your own terms!

In This Article I'll Share:

The Pitfalls of the Traditional Retirement Model

How To Embrace the New Era of Financial Freedom

Building Wealth through Cash Flowing Assets

Creating Multiple Streams of Passive Income

With every episode of Fierce Feminine Finance, I like to empower you with a POWERFUL free resource that goes with the episode which you can implement right away to create some of the same results, if not better, in your business.

This week, since we are talking about the strategies for early retirement that are ONLY available to a business owner, I put together an Ultimate Retirement Guide for Busy Business Women so you know the best questions to ask your financial advisor.

After going through this free guide you will be able to choose a strategy that will help you retire early while living the lifestyle you're currently dreaming about.

You can download it right away by clicking here or on the photo above 👆

The Pitfalls of the Traditional Retirement Model

As I mentioned before, statistics reveal a shocking reality: 78% of Americans are behind on their retirement savings. This alarming trend is probably because of the common advice to rely solely on 401(k) accounts, which have the highest fees of any brokerage account.

However, the conventional wisdom of investing in the stock market and patiently waiting for compound interest to work its magic for 40+ years has also lost its luster for a few reasons:

Today's volatile economic landscape

The dramatic increase in cost of living without a commensurate increase in pay

TikTok and other social media platforms make it easy to access information not otherwise available, leading to an increased number of Americans who realize that waiting until age 65 to live a dream lifestyle is no longer necessary

Women, in particular, face unique challenges such as the gender pay gap and career interruptions due to caregiving responsibilities, making it even more crucial to explore alternative avenues for financial security.

How To Embrace This New Era of Financial Freedom

The reliance on market-based investments for 40 years or more is no longer a viable strategy in today's fast-paced economic landscape. Business women, in particular, face unique challenges such as irregular paychecks, and the high likelihood that their income will be higher in later years than it was in the beginning, necessitating a more flexible approach to financial planning.

But with those challenges also come significant benefits and potential for wealth.

It’s time to break free from the confines of conventional wisdom and embrace a fresh perspective on wealth creation!

Rather than entrusting our financial future to Wall Street, we must seize control of our destiny by exploring alternative avenues... I'm talking about passive income in particular.

Let me explain:

The formula for how much an average woman needs in order to retire is typically based on the amount of income they would need to replace when they are no longer working at a JOB...

That retirement planning model is the generally accepted practice right among the financial advisor community, and it's distributed to the general population, but it's not the best one for business owners.

Firstly, a lot of the traditional savings vehicles don't make sense, right?

You either don't have a 401(k), or if you do there's no one else matching it! What about a traditional IRA? These are both tax deferred* retirement vehicles, which means this is great if you're an employee in a job and you're expecting to be in a lower tax bracket someday when you retire...

...But it's not so hot for business owners. Because our income tends to be higher in the time of retirement than it was in the moments when we first started filling up that retirement vehicle! (Translation: you pay more taxes)

Even if you do elect to open a ROTH 401k, you still have to deal with high fees which are the primary reason this type of account is pushed so much.

So rather than looking at how much you want to save for retirement in a 401k exclusively as a retirement plan...

...instead of asking, "How much do I need to save", I want you to ask yourself, "how much passive income do I want to have in retirement?"

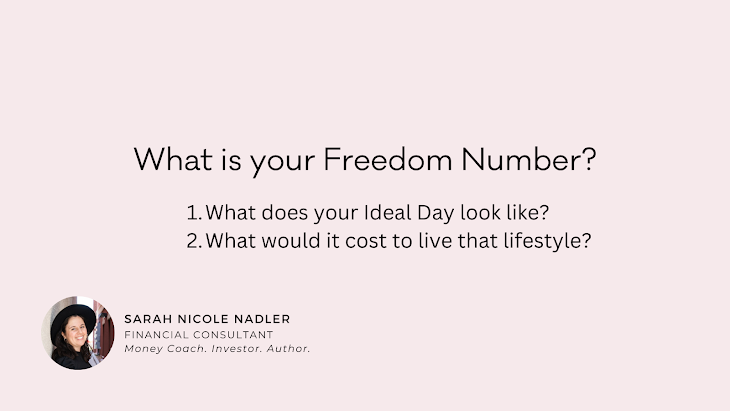

I call this your Freedom Number:

To calculate your Freedom Number, start by journaling on this question: "If I had all the time in the world, and the complete support of my family and friends...what would I be spending my days doing if I didn't have to trade time for money?"

Once you have figured out your Ideal Day, the next step is to simply calculate how much monthly passive income you would need in order to lead that lifestyle.

Okay, now that you know your Freedom Number, let's take another look at how your business can help you get there.

Building Wealth Through Cash Flowing Assets

While many women will choose to open a brokerage account (401k, IRA, etc) and save toward retirement there (and it's a good idea for most), and others plan to use their business as a retirement plan as I explain here...

Really my favorite way to build wealth as a business woman is to create an investment portfolio of cash flowing assets. There are many options out there, such as real estate investing, dividend-paying stocks, licensing out your expertise with digital products or using something like the 7702a Account, which is a type of life insurance policy. Combining any of these ideas with the sale of your business can provide a diversified portfolio of passive income streams to fund your dream lifestyle.

Unlike the unpredictable nature of market investments, cash flowing assets provide a steady stream of passive income that can grow over time, empowering you to achieve financial independence sooner rather than later.

Pro Tip: Don't try to figure this out on your own! Work with a licensed financial advisor to make sure you are taking advantage of all the options available to you as a business owner.

In Summary

The traditional Solo 401(k) approach to retirement planning no longer serves as a viable roadmap to financial security, especially for ambitious business women aiming to retire young.

By embracing the new era of financial freedom and prioritizing cash flowing assets over market-dependent investments, you can take control of your financial destiny and create a life of abundance on your own terms. It's time to break free from the shackles of outdated financial advice and pave your own path towards prosperity.

A Beginner-Friendly Class On Investing & Building Passive Income for Business Women and Entrepreneurs

Get my exclusive strategy for turning your intellectual property into passive income and growing it to 5-figures per month and beyond! FREE

© Copyright 2024 Sarah Nicole Nadler LLC. All rights reserved.

2022 All Rights Reserved.